Market Challenges

The future of commercial real estate finance

After the GFC, a multitude of new alternative lenders arose to fill the gap left by the banks which were constrained by new legislations. As a result, many specialist debt advisors started helping investors to navigate this new lending universe.

FundRE is the next step in this evolution process.

Fragmented market

There are over 350 lenders in Europe including insurance companies, pension funds, debt funds, pfandbrief banks, commercial banks, Shariah lenders and investment banks.

Evolving lending criteria

Lenders constantly update their lending criteria due to new regulations, portfolio rebalancing and market views.

High transactional cost

Commercial real estate transactions are associated with a high level of costs, are complex and time consuming, reducing the competitiveness and returns of the investments.

Limited transparency

Sponsors and lenders have little visibility on the current level of the commercial real estate financing market given its private nature and high opacity.

Limited coordination

There is often sub-efficient coordination between teams within the same institution, each office being responsible for different clients, geographies and mandates.

Limited bandwidth

Sponsors, debt advisors and lenders work in small teams in a fast-paced and highly competitive market, leading to generally limited bandwidth and a need for high efficiency.

How it works

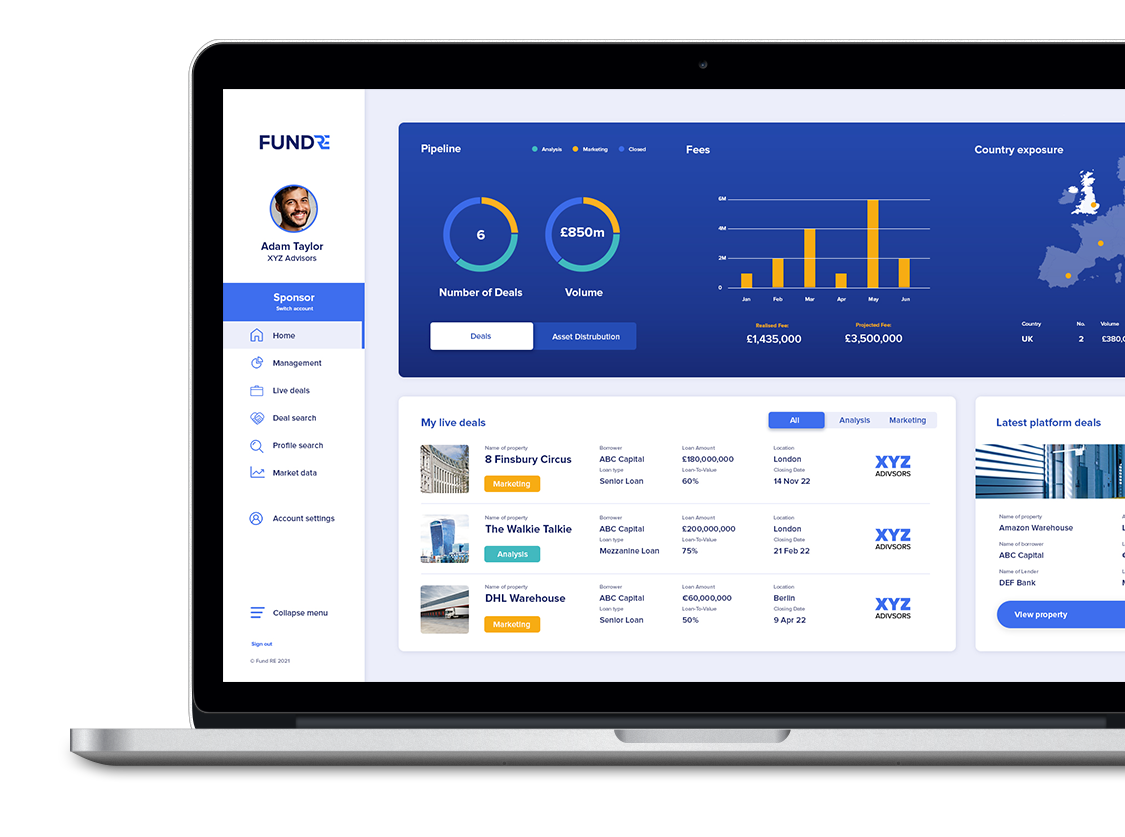

The first secured and fully dynamic origination platform

The platform streamlines the financing origination process for European commercial real estate assets, providing sponsors, debt advisors and lenders with a clear visibility of their processes at all times

1. Analysis & data compiling

The transaction information is prepared in a complete and digestible format

2. Lenders list

Based on the transaction characteristics and the loan request, a comprehensive and tailored list of lenders is generated

3. Marketing

The information is shared with some of the carefully selected lenders

4. Execution process

Q&A and data room are centralised for ease and speed of execution

5. Improved economics

Feedback and competitive financing terms are received and negotiated

6. Closing

Preferred financing terms are selected and the legal process starts

€225,000,000,000+

European Market Size

€225,000,000,000+

European Market Size

Sponsors

FundRE enables sponsors to run faster and smoother financing processes while accessing a wider lending universe

Benefits

- Increased reach across the lending universe

- Increased speed of origination

- More attractive lending terms

- More accurate underwriting

- Time efficient and automated transactional process

- Process Q&A, quotes and term sheets efficiently

- Track record and previously achieved terms easily accessible

Pricing

A success fee of 10 to 50 basis points of the agreed loan amount will be charged for any closed transaction initiated through the platform

Pricing

FundRE is currently FREE of charge for our Lenders

Lenders

Lenders are able to source new opportunities matching their lending criteria in a cost and time efficient way

Benefits

- Cost and time efficient origination platform

- Market visibility

- Increased number of transactions originated per year

- Targeted origination as per specific criteria

- Process Q&A, quotes and term sheets efficiently

- Collected data from each transaction stored and readily available for future deals

- Pipeline visibility

Debt Advisors

FundRE provides debt advisors with a powerful in-house tool to run more transactions and always keep a clear visibility of each process

Benefits

- Powerful marketing tool to pitch clients

- Increased reach across the lending universe

- More attractive lending terms achieved

- Increased chances of successful transactions

- Increased number of transactions closed each year

- Increased revenue

- Time efficient and automated transactional process

- Collected data from each transaction stored and readily available for future deals

- Pipeline visibility

Pricing

Tailored subscription agreement

The Team

Annia Labrador is the chief technology officer of FundRE and leads the development team which covers frontend, backend, data, and cloud development. Her responsibilities include technical recruitment, managing the development process, establishing good development practices and standards across the platform, coordinating all moving parts to deliver a high-quality and optimised product, and identifying technical innovation opportunities.

Elias Jaime has over 10 years of experience as a Software Engineer across several industries including Marketing, E-commerce, and Logistics. His current responsibilities include the development of new user-facing features, maintaining and improving the platform as well as optimizing performance and loading times. He works closely with the designer and backend team to constantly enhance the user experience.